Are Banks a source of Social-Economic Development in Malawi?

It is evident that SME’s are playing a vital role in the social –economic development of Malawi. One simply has to go around the trading centres, the markets and the streets in our four cities to appreciate the expansion in economic activities being handled by SME’s.

The 2012 Malawi financial scoping survey on SME’s indicates that Malawi has about 760,000 small business owners generating an annual revenue of about US$ 2 billion{around to K500 billion}.

However, the survival of Malawi’s SME’s has been the issue of great concern and worry to the nation in the past few years as the country’s economic condition has not been friendly enough to nurture growth and expansion evidenced in the closure and downsizing of many private entities due to shortage of foreign exchange, fuel, taxation policy, banking policies among others.

Malawi has one of the lowest rates of financial inclusion in Africa. According to a recent survey conducted by the ministry of trade, only 22 percent of small businesses have or use products or services offered by commercial banks.

High lending rates from commercial banks, collateral requirements, lack of business and financial management skills and the culture of aversion are some of the reasons that hinder the growth of SME’s in Malawi.

In its findings, the national statistical office {NSO} says the micro, small and medium enterprises {MSME’s} survey shows that financial exclusion of the sector is costing billions of kwacha. The report says even though the sector contributes substantial annual revenue to the country, yet about 66 percent of the sector does not have access to banking services, while 13 percent use formal but non- bank financial institutions.

Analysts’ say the banks could be using the interest rates to discourage borrowing. They say banks fear a lot of individuals and firms risk defaulting on the loans while others will have their businesses closed down.

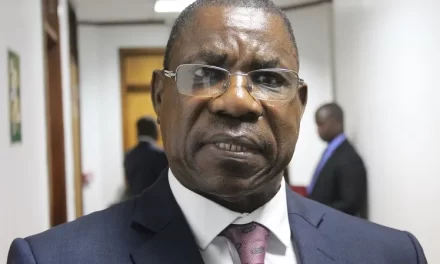

“Actually, banks are afraid to borrow the SME’s because most of them borrow to default and not to repay, hence creating a credit risk to the banks,” says Professor Mathews Chikaonda, one of the well-known economists in the country.

The NSO reports say about 71 percent of businesses owners borrow to pay back debts and 54 percent borrow to grow their businesses. The survey established that the smaller the businesses, in terms of number of employees, the less likely that the owner has or uses banking services to manage the finances of their businesses.

“Three quarters of small business owners do not borrow because they are wary of their ability to repay the loans. The largest source of credit for small businesses is friends and family, followed by village bank of cooperatives,” reads the statement about the survey.

According to records, currently, Malawi has over 12 commercial banks trading in the country. It is reported that the top four banks, NBM, Standard Bank, NBS and FMB control nearly 90 Percent of the deposits, leaving the small banks to scramble for the rest.

“There is also competition for quality customers to lend and transact with. Where quality customers are scarce banks then tend to either, take thinner margins and attract the priced clients of a lesser quality. The latter leads to more defaults and provision,” adds chikaonda, himself a board chairman for national Bank of Malawi {NBM}.

However, Reserve Bank of Malawi governor Charles Chuka expressed surprise at banks’ insistence to lend money to government and corporation alone when, he says, it is clear that capital Hill is heavily riddled with debts.

“Maybe, the only way banks in Malawi can make money is through government businesses. And, I think if that is the case, it’s unfortunate state of affairs,’” says Chuka, adding, “If the banks have nothing to lend out, they end up rising their base lending rates.

Chuka says banks classified the SME’s as ‘the risky borrowers ‘with no collateral or guarantee from their companies so they had to put the bank lending rates high.

affected agricultural production.

The danger of recording lower growth rates, as seems the case at the moment, will not make any dent on the levels of poverty in the country. The UNDP believes that any growth that is below six percent annually will have no impact on poverty reduction.

The government has to keep a firm control over public development expenditure to a level that future recurrent budgets would be able to accommodate, limiting it to the revenue available. Until recently as 1990/2000, central government expenditures were far higher than the available resources and the budget deficits were large. This led to the printing of money as the means of financing these-a phenomenon that was responsible for galloping inflation, especially in the 1990’s. Expenditure reductions had mainly been in on priority sectors, while expenditure on non-priority areas had continued to increase.

Emphasis should be put on strengthening the professional competence of the tax administration and ensuring adequate incentives, through better pay, in order to eliminate corruption. The Malawi Revenue Authority should not be a hub of politicians; it should be given powers to pounce on the tax defaulters without looking at political standing of defaulters.

A cash throw committee should be established to monitor the releases of government expenditure on a monthly basis to ensure that government budgetary operations are in line with the micro-economic objectives. A balance of payments committee should also be formed to monitor import support to ensure its consistency with the micro framework.

One of the biggest challenges facing the country is meeting public expectations. Malawians expect nothing less than an improvement in their lives through poverty reduction strategies. The gains to be made at the national levels in the form of lower interest rates, inflation and microeconomic stability need to trickle down to the poor masses.

As they say, any economic improvements are meaningless unless they are felt in the ordinary man’s pockets.