Islamic Banking in the Offing

After the Malawi government approved the introduction of Islamic banking system which doesn’t demand any interest from the borrowers as is the case with non-Islamic banking, Commercial banks in Malawi are getting prepared to open the windows.

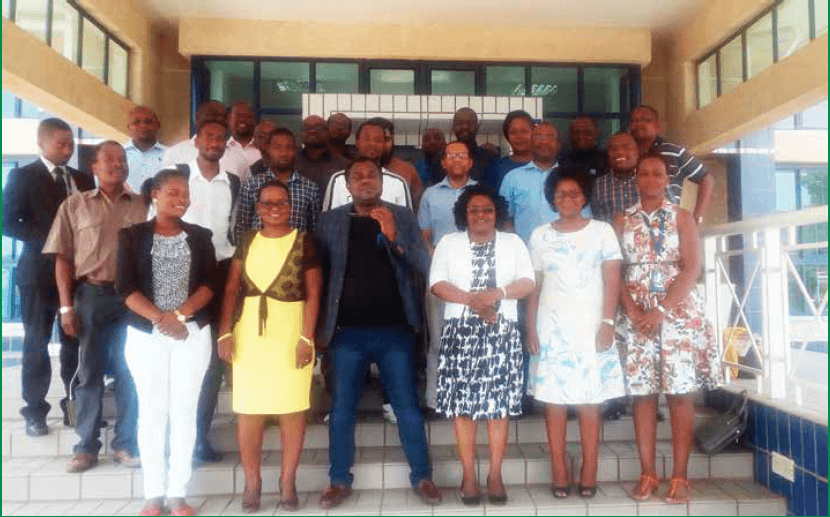

One such bank is the National Bank of Malawi which in readiness for the operations it has engaged Muft Desai a renowned Islamic Finance Scholar from South Africa to conducts a special training to its members of staff.

According to the Registrar of Financial Institutions Dalitso Kabambe who is also Governor of the Reserve Bank, the approval for now is only for the window model only. This means that all commercial banks interested to offer Islamic banking window will have to apply from the regulator, and those who meet the conditions will be issued with the certificate of compliance and start operations thereafter.

So far the regulator has already started engaging with a number of stakeholders including individual banks on how the banks can operate following guidance on reporting requirements of non interest products and other services. These guidelines have been provided to banks and the banks are currently working on them.

Malawi is perhaps the only country that has been behind on the issue of Islamic banking and finance The International Monetary Fund (IMF) in its recent report said that Islamic finance has potential to spur inclusive growth but calls for its proper regulation and supervision, a concern that Islamic finance experts admit to exist in the Islamic finance industry.

In relation to this, the Islamic Finance Task Force working under Muslim Association of Malawi has been inviting different Islamic Finance Scholars from across the world including Professor Mozer Kahf from University of Qatar , Muft Ismael Desai from South Africa among others to provide guidance and share experiences.

The Task team has been tirelessly working with relevant authorities in ensuring that Malawi adapts to the alternative banking which has no interest bearing.

Our team was tasked to lobby government to embrace the system which we think to this far we have achieved our objective, it is up to Malawians to utilise the opportunity once it arrives. This is the banking system which all Malawians will enjoy, Muslims and non-Muslims alike , said Morril Ndemanga who is the Secretary for Islamic Finance Task force but also Business Partner of the only Islamic Finance Consultancy film Muha & Mo based in Blantyre.

Among key features used in the Islamic banking include the prohibition of Interest, Islamic banking emphasises in fairness between the bank and its clients, disclosure of every transaction small or big, moral standards that embrace moral and social values of all human beings without looking at one’s faith the prohibition of gambling and many more. The system of Islamic banking and fiance is available elsewhere not only in Islamic countries but even in western and European countries where Muslims are in minority.